Data Centers, AI, and the Climate Panic Button

Italy’s energy crunch reveals the pressures of digital growth—and points to Eastern Europe and Romania as the next frontier for data infrastructure

Data-Centers-AI-and-the-Climate-Panic-Button

© KM Stock/Shutterstock

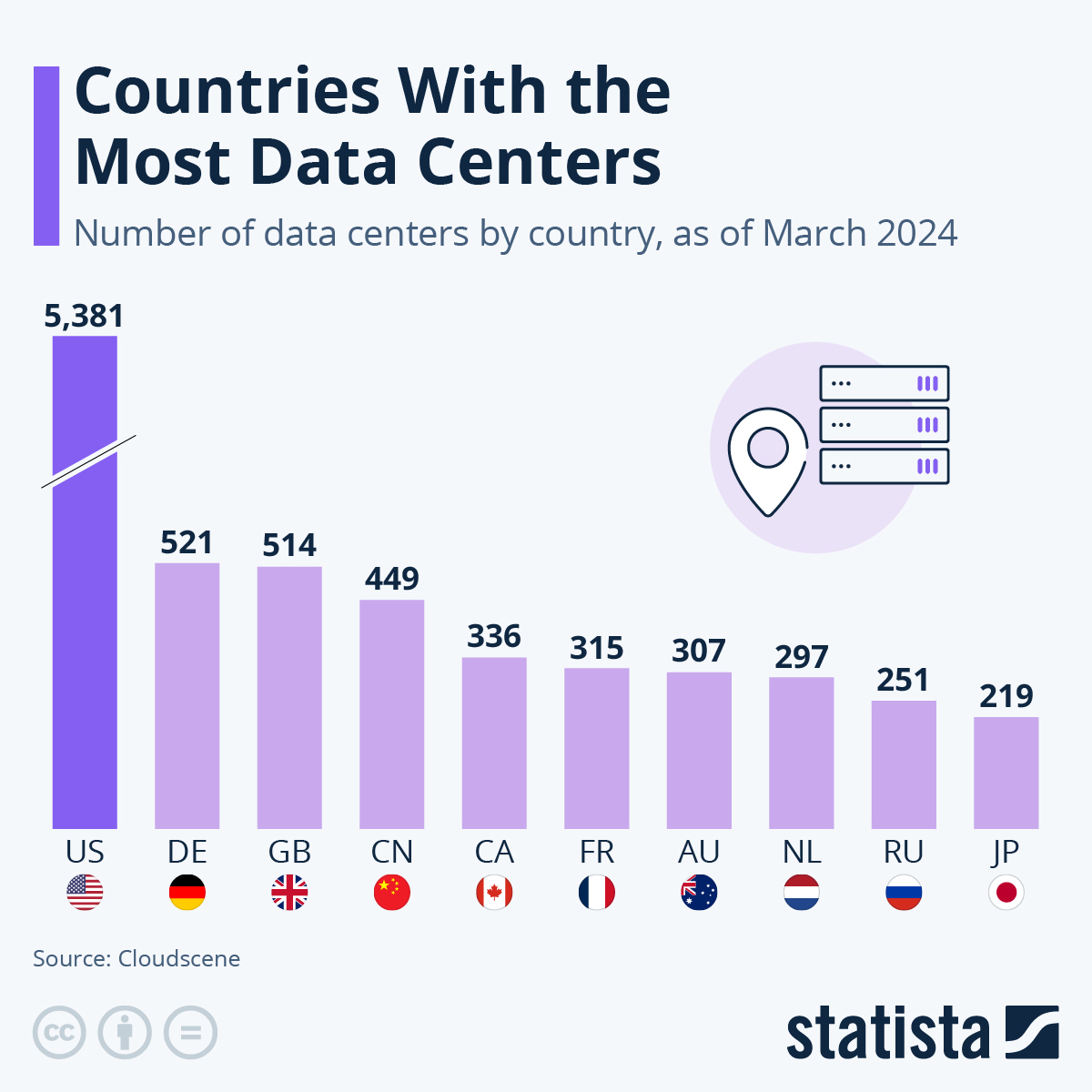

From powering our late-night scrolling to running the engines of global finance, data centers have quietly become the beating heart of the digital world. As of 2025, there are more than 8,000 data centers globally, with a heavy concentration in the United States—home to over 30% of them—followed by countries like Germany, the UK, and China. Most of these facilities are “hyperscale” centers: warehouse-like structures owned by tech players such as Amazon, Google, and Microsoft, designed to handle massive volumes of data with industrial efficiency.

Strategically located near major urban hubs or in regions with cheap electricity and cool climates, these centers are engineered for performance—a fact that has consequences. Some consume as much electricity as small cities. Cooling systems require millions of gallons of water annually. And their physical footprint continues to expand, often causing clashes with local communities over land use, energy demand, and environmental impact.

In recent years, data centers have moved from being invisible infrastructure to front-page news. Reports and research studies have highlighted their role in energy shortages, rising carbon emissions, and even conflicts over water rights, especially as the global appetite for AI, streaming, and cloud computing surges. But how alarming is the situation, really?

Looking at the case of Italy—specifically an energy crisis unfolding in Milan—we begin to see the broader implications of data-center growth across Europe. What starts as a local strain on the power grid may reveal a larger trend. And, bearing in mind the differences in context, the critical energy network issues that have emerged in this Italian metropolitan area could provide decision-makers in Eastern Europe with valuable insights when drafting strategies to prepare for the future.

Italy: the aspirations of a still energy fragile country

In Italy, the data-center sector is experiencing strong growth, with investments expected to reach up to 15 billion euros between 2025 and 2026. Artificial intelligence (AI) is predicted to further drive demand for these centers, bringing the total capacity to 1.2 GW. There are approximately 140 commercial data-center infrastructures in Italy.

The sector is experiencing a boom and further growth is expected, with investments that are set to double compared to the previous two-year period. The data centers concerned belong to both public bodies and private companies. Artificial intelligence is one of the main drivers of market growth, increasing the demand for power and capacity. In terms of service density, investments, and infrastructure, the area to which most investments are directed is the metropolitan city of Milan.

Milan’s Data-Center Challenge: Energy Concerns in a Metropolitan Hub

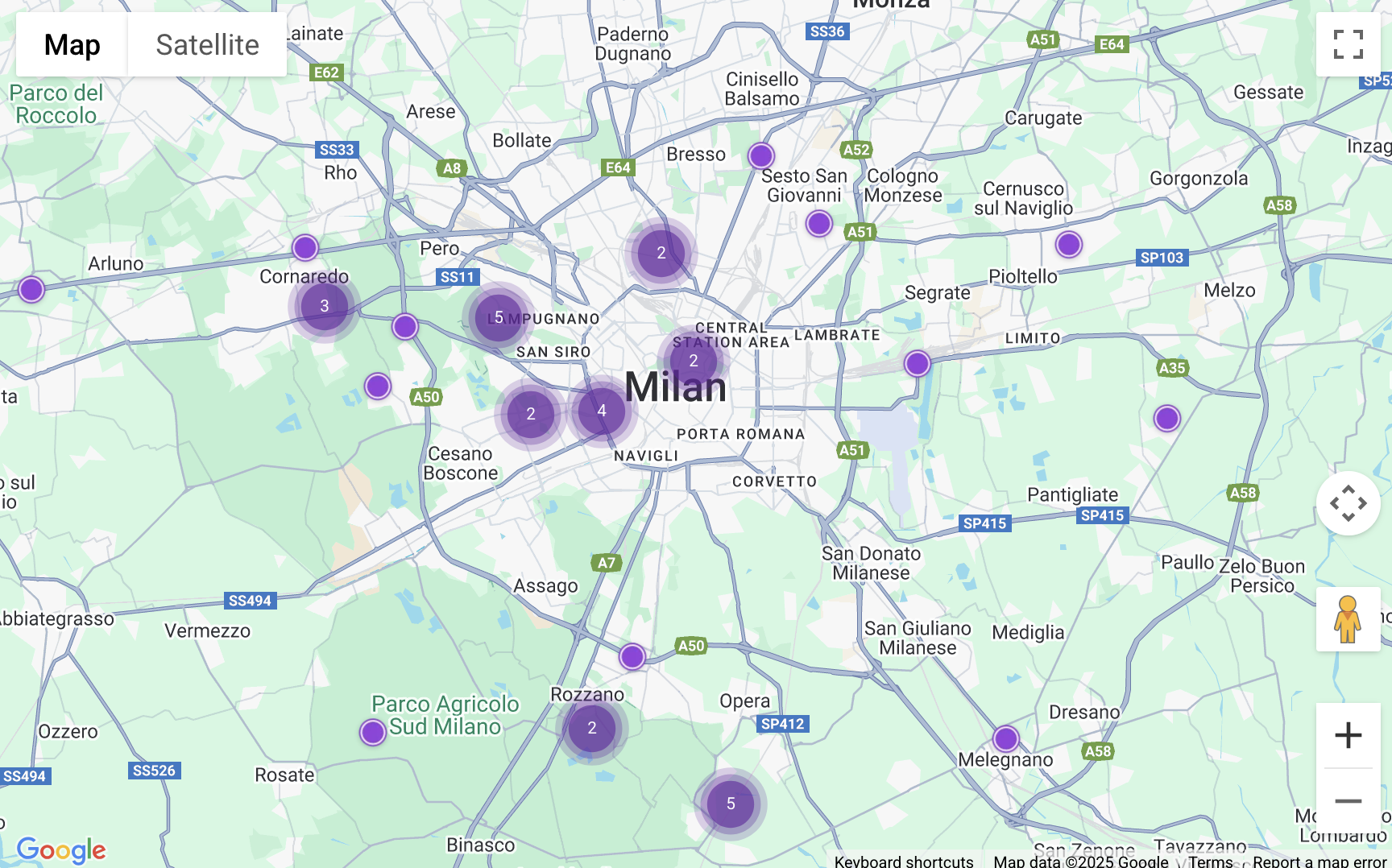

Around forty data centers and almost half of their total estimated energy capacity in Italy (238 MW out of 513 MW ) are concentrated in and around Milan. In this region, already densely populated by companies and people, the presence of these infrastructures is growing twice as fast as the rest of Italy. It is particularly the most energy-intensive data centers that choose the Milan metropolitan area, accounting for 70% of the total built nationwide.

Why so many energy calculations for these facilities, given all those already present in the region?

Their hunger for energy is beginning to worry some local institutions that complain about the "burden" that Milan alone has to manage for infrastructure that then serves the development of the entire country. The fear is that the electrical grid won’t hold up, especially during summer when it has already been under stress for years due to very high temperatures and the consequent massive use of cooling systems. The increasingly widespread thinking among administrators was made explicit during a recent meeting organized by the Digital Innovation Observatories of the Politecnico’s School of Management. Elisabetta Confalonieri, executive of the Lombardy Region observed that "Lombardy alone cannot manage this load for all of Italy if the territory does not gain effective benefits". This isn’t about energy panic, but about recognizing the need to manage data centers as special entities connected to the city grid. This requires environmental impact assessments, dedicated guidelines, tailored approval procedures, and the introduction of a specific ATECO code which the government has been discussing for months but has yet to officially approve.

If a national regulations are held up, Milan will turn to local guidelines

If such a regulation existed, from an energy standpoint, it would become mandatory to prioritize renewables and solutions that experiment with innovative district heating and cooling systems. If it existed, it would demand an enhancement of the national power grid, energy storage systems, and backup power supplies with low environmental impact. It would also require the creation of priority criteria for data centers that recover and reuse their waste heat for the benefit of the local municipality.

Impatient to set limits on the advance of data centers in Lombardy, the regional administration has developed ad hoc guidelines to try to protect the stability of its electrical system. "We are still following the Regional Law of October 12, 2015 , and the ‘classic’ permits to be requested by knocking door to door at municipalities, totally unsuitable for current needs from both an energy and authorization point of view," explains the regional councilor from the Democratic Party, Matteo Piloni. "Between 2025 and 2026, 10 billion euros will be invested in new data centers in the area, and there are no estimates on energy, water, and land consumption: there is enormous work to be done in planning that is the Region’s responsibility."

Rather than questioning the arrival of new infrastructure, what is urgent is that they are "connected" to the grid according to specific standards that must be defined without delay. More than the Municipality of Milan, it’s the smaller towns in the hinterland that are concerning: "By leaving agreements to be made by private individuals with local administrations, it is feared that the focus will be exclusively on economic development, with the risk of everything falling apart. But no one here can afford it, neither those who live here nor those who have invested," adds Piloni. "If the state is late, it’s the region that must step forward. To have an adequate national law could take up to 3 years, and by then the horses would have bolted, leaving Milan to become a wild west."

So many Davids vs. Goliaths

Municipal bodies, in fact, play a key role in developing data centers, both with reference to location and to assessments of energy needs and the overall impact of the buildings on the surrounding area.

Instead of looking with terror at a supposed ill-intentioned advance of data centers while complaining passively, it would be best to roll up our sleeves and fill the regulatory gap. The absence of specific legislation regarding the construction of data centers, at both regional and state levels, means uncertainties in implementation. This leaves ample margins of discretion to the public entities and stakeholders involved.

Municipal administrations play a crucial role in the development of data centers—both in terms of site selection and in evaluating energy requirements and the broader impact on the surrounding area. However, they often lack the necessary expertise and adequate staffing to effectively address these technical aspects. It is therefore crucial to provide uniform guidelines to them. The city of Milan and the region of Lombardy are facing a dilemma between their thirst for data centers (and business) and an awareness of having to be able to support their consumption. This can become a case study for all those metropolitan centers aspiring to be data-center hubs, both in Italy and in the rest of Europe. Whether to imitate them or not will depend on their future moves.

Romania, the emerging technology hub that attracts data centers

Concerning the future, as we look to other parts of Europe, we observe a growing development of data centers and keen strategies aimed at aligning with an increasingly digitised world.

Romania is a rising tech hub with lightning-fast internet and a growing data-center Ecosystem.

When thinking of global tech powerhouses, it might not be the first country to come to mind. Still, it has quietly become a digital leader, particularly when it comes to internet infrastructure. With some of the fastest average broadband speeds in the world, Romania consistently ranks among the top global performers. Cities like Bucharest, Cluj-Napoca, and Timișoara offer lightning-fast gigabit connections that outpace many Western European and even U.S. counterparts, all at remarkably affordable prices.

The reason is Romania’s early investment in fiber-optic networks and the unique way the infrastructure was developed. Rather than relying heavily on legacy systems, Romania jumped into the fiber age during the early 2000s, leading to widespread availability even in many rural areas. But its tech evolution goes beyond fast internet. It boasts a highly skilled IT workforce and a growing startup ecosystem, becoming all at the same time a nearshoring hub for European and U.S. companies alike.

The Rise of Data Centers in Romania

As Romania’s digital infrastructure matures, the country is also making significant strides in the development of its data-center landscape. With all of the above-mentioned characteristics, it is increasingly seen as an attractive location for hosting services, and cloud infrastructure. As a matter of fact, back in 2018, a short research study performed by the British consultancy, Savills (https://pdf.euro.savills.co.uk/european/savills-european-datacentres—april-18-final.pdf ) placed Romania 6th in the ranking of the most suitable European countries to build a data center. The ranking is based on an analysis of 12 indicators, including average annual temperature, incidence and damage caused by natural disasters, cybersecurity, electricity prices, availability of green energy, available bandwidth, fiber network penetration rate, etc.

Romania has yet to host a full-scale hyperscale data center from tech giants like Microsoft and Amazon Web Services, but the groundwork is being laid.

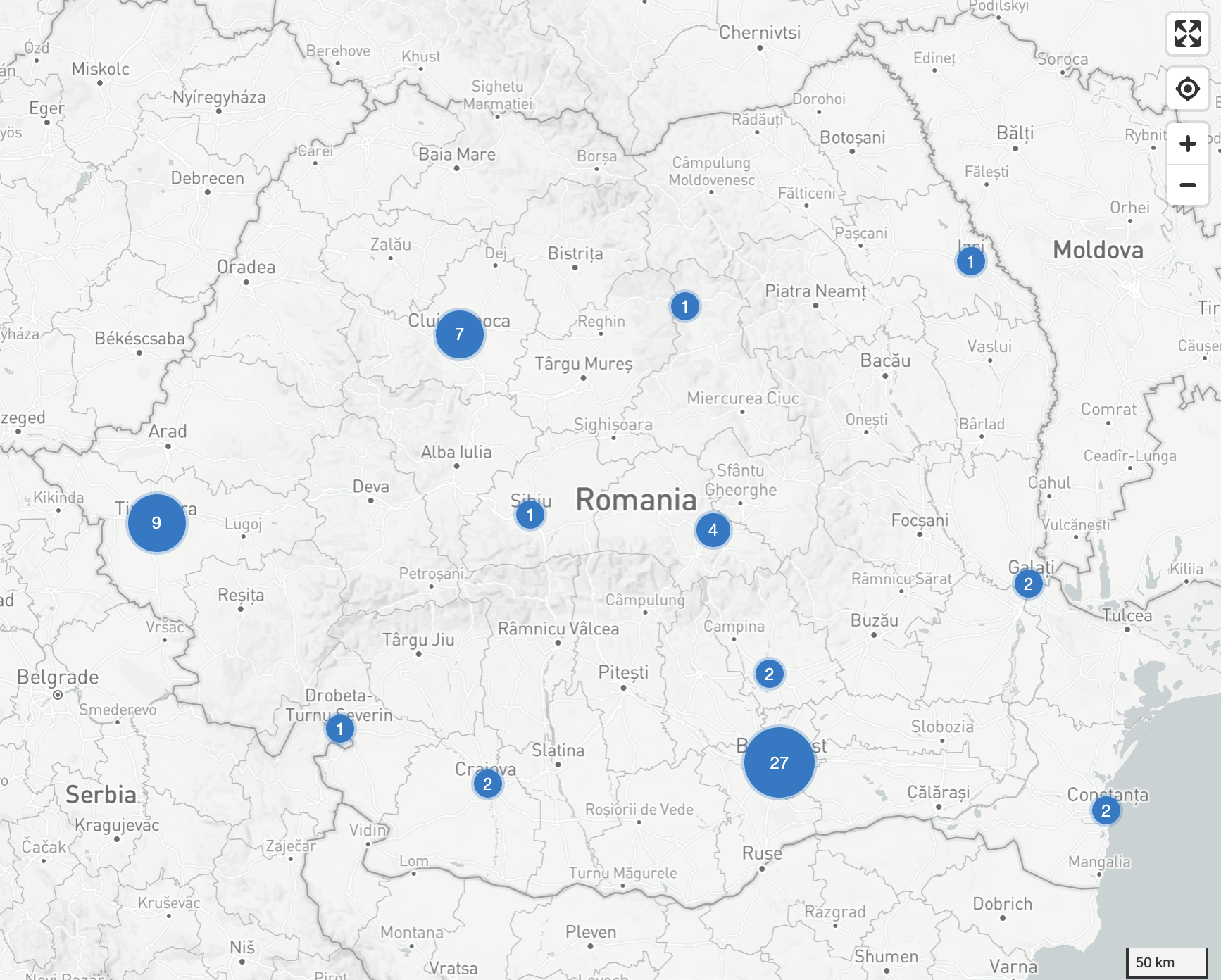

Bucharest, the capital, is the epicenter of data-center activity, followed by Timisoara, Constanta, Cluj, Brasov, Craiova, and other cities, with a total of 59 locations.

The players that operate here range from local providers to international players. Notably, Telekom Romania, Orange Romania, and Vodafone offer large-scale data-center services. These facilities typically provide Tier III or higher standards, with redundant power, cooling, and network systems to ensure uptime and reliability.

One of the standout players in the Romanian data-center ecosystem is NXDATA, an independent provider based in Bucharest. NXDATA operates two carrier-neutral data centers and serves as a crucial internet exchange point (IXP) for the region. It is a gateway between East and West, linking Central Europe to the Balkans, the Middle East, and beyond.

The most powerful data center, on the other hand, is ClusterPower from Craiova, an investment of almost 40 million euros that covers an area of 25,000 square meters including an Artificial Intelligence infrastructure center, developed with Nvidia technology. What is interesting about ClusterPower is that it has developed its own energy source, using a 200 MW trigeneration plant, thus emphasizing how important it is for the electricity demand to be met by renewable generation and not by carbon-intensive fossil fuels.

Per capita, the capacity of data centers in Romania is only 3.2W, well below the average of the Nordic countries, which are at the top of the ranking with 22.6W, but also below the average of Central and Eastern Europe, where the capacity is 4.5W. However, data centers in Romania have the advantage of having one of the lowest Power Usage Effectiveness (PUE) coefficients, estimated at 1.37, well below the European average and very close to that of the Nordic countries, according to a study by Crosspoint Real Estate.

Future investments in Romania

Two new data centers with a combined capacity of 40-45 MW are being considered for construction in 2025 Romania, representing a total investment of almost 500 million euros, according to data from Knight Frank, a real estate consultancy cited by Romania’s Ziarul Financiar. Taking into account the expansion of artificial intelligence and the migration to the cloud, there is potential in Romania for 100 MW of data centers.

A leading cryptocurrency mining platform, operating since 2022, has also announced the acquisition of a new datacenter in Iron Gate, Romania. This strategic expansion is part of the company’s ongoing efforts to scale its operations, improve mining efficiency, and meet the growing demands of the global crypto market.

Is Romanian worried about the future expansion of data centers, energy consumption and environmental issues?

The concern regarding the sustainability of data centers and the impact on the environment is widely shared. Romanian journalists are also shedding light on the subject. Currently, data centers in Romania reflect the broader economic development occurring across various regions of the country—some of which are underdeveloped and in need of revitalization. These centers also help position Romania on the international digitalization map by leveraging both its human and natural resources. The government has actively encouraged this type of investment, and the shift of the data-center industry toward regions like Romania is a foreseeable trend.

Most international analysts believe that the dramatic reduction in available data-center space in well-known data center hubs (the UK, France, Netherlands, Germany, Ireland, etc.) will lead more and more investors to shift to secondary markets: Eastern Europe and Scandinavia. Thus, over the next few years, the main investments will be directed to places where the cost of land, energy and human resources is lower, but where there are also efficient communication nodes, sufficient and green electricity and the technical capabilities to build and operate large data centers.

Significant investments have been made in Czechia, Hungary, Bulgaria, Croatia, Estonia, Slovakia, and Greece. And if all goes as planned, Reuters reports that by 2030, one of the most powerful data-center hubs will open in Portugal, to meet growing demand from major tech and artificial intelligence companies. Whether this development will intensify existing challenges or help to mitigate them remains to be seen

Data centers are expanding into regions offering optimal environmental and logistical conditions. It will be crucial to select appropriate locations and implement the most efficient technologies. Moreover, government policies and sustainability reporting are and will be increasingly essential—not only to meet regulatory requirements but also to ensure transparency and accountability in how energy and resources are being used.

The rise of AI can feel overwhelming at times. But that sense of panic we might get—especially with how fast things are moving—can be dialed down by looking at the bigger picture through solid research. One study worth highlighting comes from George Kamiya and Vlad Coroamă (Roegen Centre for Sustainability) and was published this April .

Their focus? The energy use of data centers, particularly in the context of AI.

The report, commissioned by EDNA—an initiative linked to the International Energy Agency (IEA)—dives into more than 100 studies and 60 sustainability reports from the biggest players in the data-center world. It offers a clear-eyed review of current estimates and takes a closer look at how AI is influencing energy demand.

As per the authors’ conclusions, current global consumption estimates vary sixfold, ranging between 200 and 1,200 terawatt-hours (TWh) annually, while forecasts for 2030 vary fortyfold—from 200 to 8,000 TWh per year. The highest-end estimates, which received the most attention in the media, strongly correlate with low-quality studies. In contrast, medium- and high-quality studies produce much more conservative results.

Estimates of around 300–400 TWh for 2023 from good-quality global studies are consistent with aggregated regional studies and with data from individual companies. AI-driven consumption, currently still marginal at around 30–50 TWh, is expected to grow rapidly. Even here, estimates for 2030 vary significantly, ranging from 200 to 1,000 TWh.

The most likely scenario is that energy consumption from AI in data centers will reach around 300 TWh by 2030, with high probability in the 200–400 TWh range. Total data center consumption is expected to be around 700–900 TWh.

So, AI will account for just under 1% of global electricity consumption (which is about 30,000 TWh per year and growing), and just over 0.1% of global primary energy consumption (around 200,000 TWh annually).

Due to very high power density (an Nvidia NVL72 rack with 36 GB200 superchips consumes over 100 kW; AI-dedicated data centers can draw hundreds of MW, even over 1 GW), there is a growing interest in nuclear reactors for AI.

AI can thus become a local problem, as shown in the case of Milan, in terms of electricity production and transmission, and potentially through water consumption (both via evaporative cooling in the data center and water used in electricity generation). But globally, among all human energy-consuming activities, AI will remain negligible and will most certainly not fry our planet.

This publication has been produced within the Collaborative and Investigative Journalism Initiative (CIJI ), a project co-funded by the European Commission. The contents of this publication are the sole responsibility of Osservatorio Balcani Caucaso Transeuropa and do not reflect the views of the European Union. Go to the project page

Tag: CIJI

Data Centers, AI, and the Climate Panic Button

Italy’s energy crunch reveals the pressures of digital growth—and points to Eastern Europe and Romania as the next frontier for data infrastructure

Data-Centers-AI-and-the-Climate-Panic-Button

© KM Stock/Shutterstock

From powering our late-night scrolling to running the engines of global finance, data centers have quietly become the beating heart of the digital world. As of 2025, there are more than 8,000 data centers globally, with a heavy concentration in the United States—home to over 30% of them—followed by countries like Germany, the UK, and China. Most of these facilities are “hyperscale” centers: warehouse-like structures owned by tech players such as Amazon, Google, and Microsoft, designed to handle massive volumes of data with industrial efficiency.

Strategically located near major urban hubs or in regions with cheap electricity and cool climates, these centers are engineered for performance—a fact that has consequences. Some consume as much electricity as small cities. Cooling systems require millions of gallons of water annually. And their physical footprint continues to expand, often causing clashes with local communities over land use, energy demand, and environmental impact.

In recent years, data centers have moved from being invisible infrastructure to front-page news. Reports and research studies have highlighted their role in energy shortages, rising carbon emissions, and even conflicts over water rights, especially as the global appetite for AI, streaming, and cloud computing surges. But how alarming is the situation, really?

Looking at the case of Italy—specifically an energy crisis unfolding in Milan—we begin to see the broader implications of data-center growth across Europe. What starts as a local strain on the power grid may reveal a larger trend. And, bearing in mind the differences in context, the critical energy network issues that have emerged in this Italian metropolitan area could provide decision-makers in Eastern Europe with valuable insights when drafting strategies to prepare for the future.

Italy: the aspirations of a still energy fragile country

In Italy, the data-center sector is experiencing strong growth, with investments expected to reach up to 15 billion euros between 2025 and 2026. Artificial intelligence (AI) is predicted to further drive demand for these centers, bringing the total capacity to 1.2 GW. There are approximately 140 commercial data-center infrastructures in Italy.

The sector is experiencing a boom and further growth is expected, with investments that are set to double compared to the previous two-year period. The data centers concerned belong to both public bodies and private companies. Artificial intelligence is one of the main drivers of market growth, increasing the demand for power and capacity. In terms of service density, investments, and infrastructure, the area to which most investments are directed is the metropolitan city of Milan.

Milan’s Data-Center Challenge: Energy Concerns in a Metropolitan Hub

Around forty data centers and almost half of their total estimated energy capacity in Italy (238 MW out of 513 MW ) are concentrated in and around Milan. In this region, already densely populated by companies and people, the presence of these infrastructures is growing twice as fast as the rest of Italy. It is particularly the most energy-intensive data centers that choose the Milan metropolitan area, accounting for 70% of the total built nationwide.

Why so many energy calculations for these facilities, given all those already present in the region?

Their hunger for energy is beginning to worry some local institutions that complain about the "burden" that Milan alone has to manage for infrastructure that then serves the development of the entire country. The fear is that the electrical grid won’t hold up, especially during summer when it has already been under stress for years due to very high temperatures and the consequent massive use of cooling systems. The increasingly widespread thinking among administrators was made explicit during a recent meeting organized by the Digital Innovation Observatories of the Politecnico’s School of Management. Elisabetta Confalonieri, executive of the Lombardy Region observed that "Lombardy alone cannot manage this load for all of Italy if the territory does not gain effective benefits". This isn’t about energy panic, but about recognizing the need to manage data centers as special entities connected to the city grid. This requires environmental impact assessments, dedicated guidelines, tailored approval procedures, and the introduction of a specific ATECO code which the government has been discussing for months but has yet to officially approve.

If a national regulations are held up, Milan will turn to local guidelines

If such a regulation existed, from an energy standpoint, it would become mandatory to prioritize renewables and solutions that experiment with innovative district heating and cooling systems. If it existed, it would demand an enhancement of the national power grid, energy storage systems, and backup power supplies with low environmental impact. It would also require the creation of priority criteria for data centers that recover and reuse their waste heat for the benefit of the local municipality.

Impatient to set limits on the advance of data centers in Lombardy, the regional administration has developed ad hoc guidelines to try to protect the stability of its electrical system. "We are still following the Regional Law of October 12, 2015 , and the ‘classic’ permits to be requested by knocking door to door at municipalities, totally unsuitable for current needs from both an energy and authorization point of view," explains the regional councilor from the Democratic Party, Matteo Piloni. "Between 2025 and 2026, 10 billion euros will be invested in new data centers in the area, and there are no estimates on energy, water, and land consumption: there is enormous work to be done in planning that is the Region’s responsibility."

Rather than questioning the arrival of new infrastructure, what is urgent is that they are "connected" to the grid according to specific standards that must be defined without delay. More than the Municipality of Milan, it’s the smaller towns in the hinterland that are concerning: "By leaving agreements to be made by private individuals with local administrations, it is feared that the focus will be exclusively on economic development, with the risk of everything falling apart. But no one here can afford it, neither those who live here nor those who have invested," adds Piloni. "If the state is late, it’s the region that must step forward. To have an adequate national law could take up to 3 years, and by then the horses would have bolted, leaving Milan to become a wild west."

So many Davids vs. Goliaths

Municipal bodies, in fact, play a key role in developing data centers, both with reference to location and to assessments of energy needs and the overall impact of the buildings on the surrounding area.

Instead of looking with terror at a supposed ill-intentioned advance of data centers while complaining passively, it would be best to roll up our sleeves and fill the regulatory gap. The absence of specific legislation regarding the construction of data centers, at both regional and state levels, means uncertainties in implementation. This leaves ample margins of discretion to the public entities and stakeholders involved.

Municipal administrations play a crucial role in the development of data centers—both in terms of site selection and in evaluating energy requirements and the broader impact on the surrounding area. However, they often lack the necessary expertise and adequate staffing to effectively address these technical aspects. It is therefore crucial to provide uniform guidelines to them. The city of Milan and the region of Lombardy are facing a dilemma between their thirst for data centers (and business) and an awareness of having to be able to support their consumption. This can become a case study for all those metropolitan centers aspiring to be data-center hubs, both in Italy and in the rest of Europe. Whether to imitate them or not will depend on their future moves.

Romania, the emerging technology hub that attracts data centers

Concerning the future, as we look to other parts of Europe, we observe a growing development of data centers and keen strategies aimed at aligning with an increasingly digitised world.

Romania is a rising tech hub with lightning-fast internet and a growing data-center Ecosystem.

When thinking of global tech powerhouses, it might not be the first country to come to mind. Still, it has quietly become a digital leader, particularly when it comes to internet infrastructure. With some of the fastest average broadband speeds in the world, Romania consistently ranks among the top global performers. Cities like Bucharest, Cluj-Napoca, and Timișoara offer lightning-fast gigabit connections that outpace many Western European and even U.S. counterparts, all at remarkably affordable prices.

The reason is Romania’s early investment in fiber-optic networks and the unique way the infrastructure was developed. Rather than relying heavily on legacy systems, Romania jumped into the fiber age during the early 2000s, leading to widespread availability even in many rural areas. But its tech evolution goes beyond fast internet. It boasts a highly skilled IT workforce and a growing startup ecosystem, becoming all at the same time a nearshoring hub for European and U.S. companies alike.

The Rise of Data Centers in Romania

As Romania’s digital infrastructure matures, the country is also making significant strides in the development of its data-center landscape. With all of the above-mentioned characteristics, it is increasingly seen as an attractive location for hosting services, and cloud infrastructure. As a matter of fact, back in 2018, a short research study performed by the British consultancy, Savills (https://pdf.euro.savills.co.uk/european/savills-european-datacentres—april-18-final.pdf ) placed Romania 6th in the ranking of the most suitable European countries to build a data center. The ranking is based on an analysis of 12 indicators, including average annual temperature, incidence and damage caused by natural disasters, cybersecurity, electricity prices, availability of green energy, available bandwidth, fiber network penetration rate, etc.

Romania has yet to host a full-scale hyperscale data center from tech giants like Microsoft and Amazon Web Services, but the groundwork is being laid.

Bucharest, the capital, is the epicenter of data-center activity, followed by Timisoara, Constanta, Cluj, Brasov, Craiova, and other cities, with a total of 59 locations.

The players that operate here range from local providers to international players. Notably, Telekom Romania, Orange Romania, and Vodafone offer large-scale data-center services. These facilities typically provide Tier III or higher standards, with redundant power, cooling, and network systems to ensure uptime and reliability.

One of the standout players in the Romanian data-center ecosystem is NXDATA, an independent provider based in Bucharest. NXDATA operates two carrier-neutral data centers and serves as a crucial internet exchange point (IXP) for the region. It is a gateway between East and West, linking Central Europe to the Balkans, the Middle East, and beyond.

The most powerful data center, on the other hand, is ClusterPower from Craiova, an investment of almost 40 million euros that covers an area of 25,000 square meters including an Artificial Intelligence infrastructure center, developed with Nvidia technology. What is interesting about ClusterPower is that it has developed its own energy source, using a 200 MW trigeneration plant, thus emphasizing how important it is for the electricity demand to be met by renewable generation and not by carbon-intensive fossil fuels.

Per capita, the capacity of data centers in Romania is only 3.2W, well below the average of the Nordic countries, which are at the top of the ranking with 22.6W, but also below the average of Central and Eastern Europe, where the capacity is 4.5W. However, data centers in Romania have the advantage of having one of the lowest Power Usage Effectiveness (PUE) coefficients, estimated at 1.37, well below the European average and very close to that of the Nordic countries, according to a study by Crosspoint Real Estate.

Future investments in Romania

Two new data centers with a combined capacity of 40-45 MW are being considered for construction in 2025 Romania, representing a total investment of almost 500 million euros, according to data from Knight Frank, a real estate consultancy cited by Romania’s Ziarul Financiar. Taking into account the expansion of artificial intelligence and the migration to the cloud, there is potential in Romania for 100 MW of data centers.

A leading cryptocurrency mining platform, operating since 2022, has also announced the acquisition of a new datacenter in Iron Gate, Romania. This strategic expansion is part of the company’s ongoing efforts to scale its operations, improve mining efficiency, and meet the growing demands of the global crypto market.

Is Romanian worried about the future expansion of data centers, energy consumption and environmental issues?

The concern regarding the sustainability of data centers and the impact on the environment is widely shared. Romanian journalists are also shedding light on the subject. Currently, data centers in Romania reflect the broader economic development occurring across various regions of the country—some of which are underdeveloped and in need of revitalization. These centers also help position Romania on the international digitalization map by leveraging both its human and natural resources. The government has actively encouraged this type of investment, and the shift of the data-center industry toward regions like Romania is a foreseeable trend.

Most international analysts believe that the dramatic reduction in available data-center space in well-known data center hubs (the UK, France, Netherlands, Germany, Ireland, etc.) will lead more and more investors to shift to secondary markets: Eastern Europe and Scandinavia. Thus, over the next few years, the main investments will be directed to places where the cost of land, energy and human resources is lower, but where there are also efficient communication nodes, sufficient and green electricity and the technical capabilities to build and operate large data centers.

Significant investments have been made in Czechia, Hungary, Bulgaria, Croatia, Estonia, Slovakia, and Greece. And if all goes as planned, Reuters reports that by 2030, one of the most powerful data-center hubs will open in Portugal, to meet growing demand from major tech and artificial intelligence companies. Whether this development will intensify existing challenges or help to mitigate them remains to be seen

Data centers are expanding into regions offering optimal environmental and logistical conditions. It will be crucial to select appropriate locations and implement the most efficient technologies. Moreover, government policies and sustainability reporting are and will be increasingly essential—not only to meet regulatory requirements but also to ensure transparency and accountability in how energy and resources are being used.

The rise of AI can feel overwhelming at times. But that sense of panic we might get—especially with how fast things are moving—can be dialed down by looking at the bigger picture through solid research. One study worth highlighting comes from George Kamiya and Vlad Coroamă (Roegen Centre for Sustainability) and was published this April .

Their focus? The energy use of data centers, particularly in the context of AI.

The report, commissioned by EDNA—an initiative linked to the International Energy Agency (IEA)—dives into more than 100 studies and 60 sustainability reports from the biggest players in the data-center world. It offers a clear-eyed review of current estimates and takes a closer look at how AI is influencing energy demand.

As per the authors’ conclusions, current global consumption estimates vary sixfold, ranging between 200 and 1,200 terawatt-hours (TWh) annually, while forecasts for 2030 vary fortyfold—from 200 to 8,000 TWh per year. The highest-end estimates, which received the most attention in the media, strongly correlate with low-quality studies. In contrast, medium- and high-quality studies produce much more conservative results.

Estimates of around 300–400 TWh for 2023 from good-quality global studies are consistent with aggregated regional studies and with data from individual companies. AI-driven consumption, currently still marginal at around 30–50 TWh, is expected to grow rapidly. Even here, estimates for 2030 vary significantly, ranging from 200 to 1,000 TWh.

The most likely scenario is that energy consumption from AI in data centers will reach around 300 TWh by 2030, with high probability in the 200–400 TWh range. Total data center consumption is expected to be around 700–900 TWh.

So, AI will account for just under 1% of global electricity consumption (which is about 30,000 TWh per year and growing), and just over 0.1% of global primary energy consumption (around 200,000 TWh annually).

Due to very high power density (an Nvidia NVL72 rack with 36 GB200 superchips consumes over 100 kW; AI-dedicated data centers can draw hundreds of MW, even over 1 GW), there is a growing interest in nuclear reactors for AI.

AI can thus become a local problem, as shown in the case of Milan, in terms of electricity production and transmission, and potentially through water consumption (both via evaporative cooling in the data center and water used in electricity generation). But globally, among all human energy-consuming activities, AI will remain negligible and will most certainly not fry our planet.

This publication has been produced within the Collaborative and Investigative Journalism Initiative (CIJI ), a project co-funded by the European Commission. The contents of this publication are the sole responsibility of Osservatorio Balcani Caucaso Transeuropa and do not reflect the views of the European Union. Go to the project page

Tag: CIJI